Educational Improvement Tax Credit

The Educational Improvement Tax Credit (EITC) program allows Pennsylvania-based businesses and Special Purpose Entities (SPEs) to receive generous tax credits by contributing to qualified educational organizations. As a recipient of EITC funds, Stroud Water Research Center makes its school programs, field trips, and professional development workshops available at no or reduced cost to Pennsylvania public school districts.

The Stroud Center offers a variety of programs and workshops aimed at helping students and teachers understand many of the science concepts in their schools’ curricula by direct, concrete and academic exposure to their local streams and regional watersheds. These programs are rooted in the most up-to-date research and are tied directly to Pennsylvania’s Academic Standards for Environment and Ecology and Science and Technology.

How EITC Works

- Businesses and SPEs apply for the program on Pennsylvania’s EITC website.

- Approved businesses and SPEs designate the Stroud Center as an EITC recipient by contacting Steve Kerlin or Jessica Provinski.

- The Stroud Center uses EITC funds to provide innovative programs at no or reduced cost to Pennsylvania public school districts.

We are grateful to the following businesses for providing EITC funds to support program scholarships!

2023-2024 EITC Donors

2022-2023 EITC Donors

2021-2022 EITC Donors

EITC News

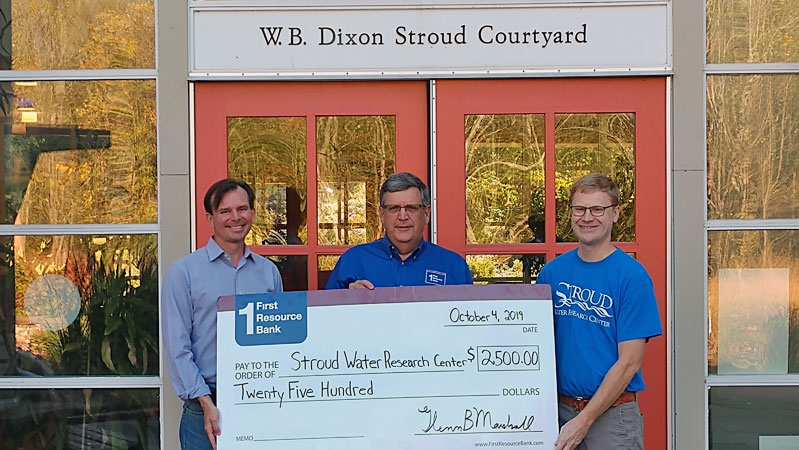

First Resource Bank Boosts Its Support of Education Programming

First Resource Bank Contribution Boosts Virtual and In-Person Education Programming

Student Voices Return to Stroud Water Research Center During COVID-19 Education Programming

BB&T, Now Truist, Renews Its EITC Support

Thank You, First Resource Bank!